Best Way To Keep Track of Invoices and Payments: {A Guide}

TL;DR: If you wanna automate your invoice tracking, you can get started with Hubspot Commerce. This tool comes with a free trial. Get started and take a test drive!

Are you looking for the best way to keep track of Invoices?

You are welcome!

Are you grappling with overdue payments and struggling to keep track of your invoices? Managing invoice payments, especially when dealing with late invoices, outstanding payments, and the hassle of paper invoices, can feel like a puzzle without a solution.

However, fear not! Efficient payment collection and invoice tracking have become easier with Payment Tracking software like Hubspot.

In this detailed guide, we’ll navigate through the intricacies of payment collection, overdue invoices, and effective invoice tracking methods.

By using the Hubspot smart payment tracking software and establishing a streamlined system for managing invoice details, you can gain better control over your business expenses and mitigate loss reports.

Let’s dive in and read more about it-

- Best Way To Keep Track of Invoices For Your Customers

- 1. An Overview of HubSpot’s Invoicing Features

- 2. Setting Up Your Invoicing System in HubSpot

- 3. Automating Invoice Generation

- 4. Managing and Tracking Invoices

- 5. Integrating Payment Gateways and Reminders

- 6. Leveraging Automation for Follow-Ups and Communication

- 7. Training Your Team for Effective Invoicing

- Frequently Asked Questions About Invoice Tracking System

- Final Thoughts

Best Way To Keep Track of Invoices For Your Customers

Keeping track of invoices is crucial for the smooth operation of any business. Without an organized system in place, it can be easy to lose track of unpaid invoices, leading to cash flow issues and potential disputes with clients.

To effectively keep track of invoices, businesses should utilize a combination of digital tools and best practices to streamline the process and ensure accuracy and efficiency.

1. An Overview of HubSpot’s Invoicing Features

HubSpot’s invoicing system is an amazing feature that stands out for its seamless integration with popular accounting software like QuickBooks, Xero, and NetSuite.

This integration simplifies the recording of transactions, managing both accounts payable and receivable, and tracking financial data across different platforms.

This smart integration of HubSpot’s Invoicing system with leading accounting software enables businesses to streamline their financial operations.

By linking these platforms, companies can effortlessly consolidate and access real-time insights into their cash flow, revenue, and expenses.

This integration facilitates a smoother workflow, eliminating the need to toggle between different systems and ensuring a more cohesive financial overview.

The beauty of this integration lies in the way it empowers better decision-making. With access to accurate and up-to-date financial information, managers can make informed choices, steering the company in the right direction.

2. Setting Up Your Invoicing System in HubSpot

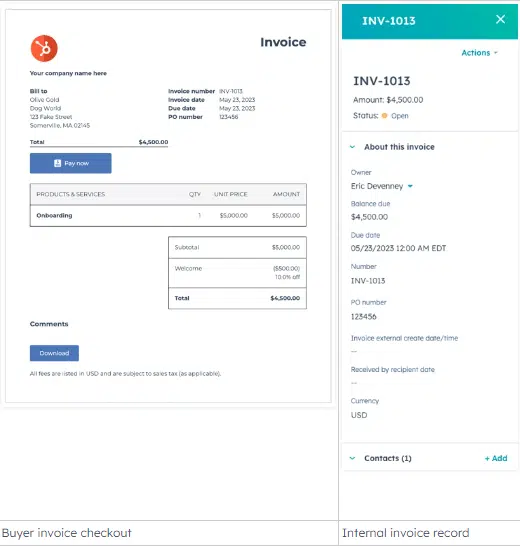

Setting up your invoicing system in HubSpot is a pivotal step in streamlining your financial processes, offering a range of tools that enhance your ability to manage invoices, track payments, and present professional-looking invoices that leave a direct impact on your business model.

You can manage user permissions, ensuring that authorized team members have access to the invoice tracker, and enabling streamlined tracking of outstanding invoices and incoming payments.

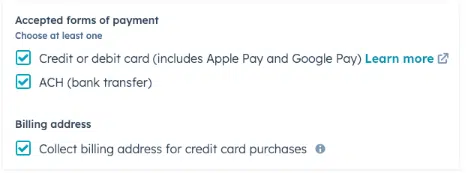

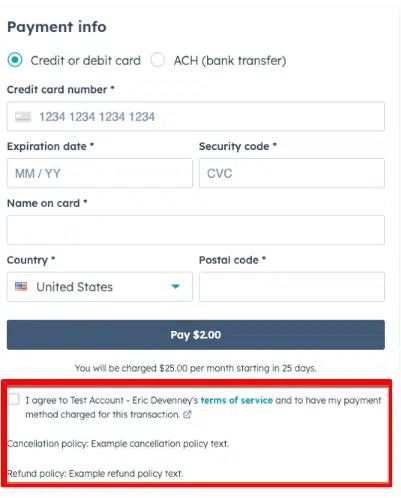

The system allows seamless integration of accounting programs and supports various payment methods, including credit card payments and bank accounts.

This integration plays a direct role in the tracking process, enabling you to maintain a clear track of payments received and those pending.

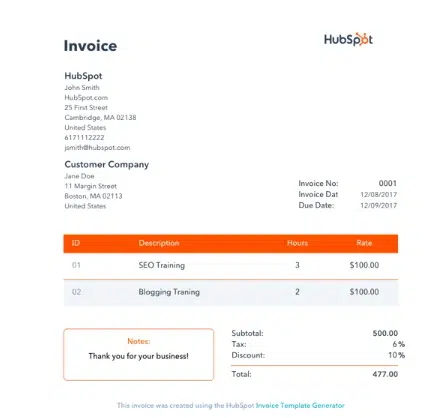

You can set up HubSpot to generate professional-looking invoices using pre-designed templates, ensuring consistency in appearance while reflecting your brand identity. The best thing you can get is a customizable invoice tracking process.

HubSpot’s invoicing system doesn’t just manage invoices; it equips you with invoice-tracking software that enhances your business’s financial control.

Through this software, you can gain valuable insights into your financial landscape, allowing better decision-making and a more robust understanding of your business’s cash flow.

3. Automating Invoice Generation

Automating your invoice workflow using HubSpot offers a convenient way to handle professional invoices and streamline invoice processing.

You can gain access to efficient invoice management tools and an invoice tracker template that simplifies handling late payments, outgoing payments, and tracking payments.

This automated system helps in processing invoices more effectively, ensuring accuracy and timeliness in dealing with invoices within the accounting department.

The system utilizes accounting software programs and cloud-based accounting software to manage original invoices and handle various accounting processes seamlessly.

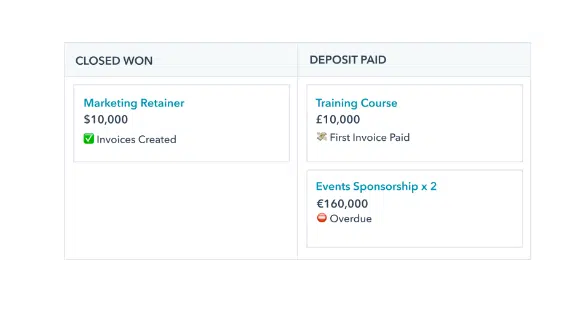

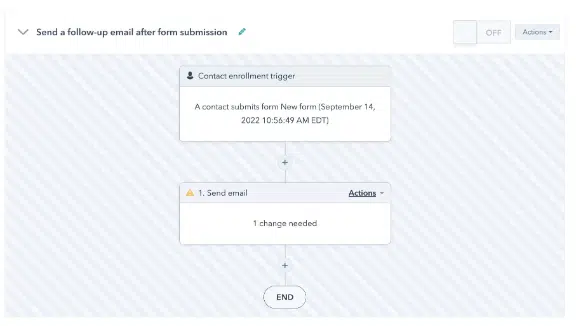

Utilizing workflows in HubSpot based on specialized properties such as invoice status, total amounts, overdue invoices, and custom settings, allows for tailored responses to specific triggers.

For instance, when an invoice is paid or becomes overdue, these workflows can automatically update deal stages or alert relevant teams about payment status.

Moreover, for businesses seeking more control and customization, advanced options are available. These options allow the creation of personalized sections in HubSpot deals, matching unique requirements precisely.

This customization ensures specific triggers and actions tailored to the business needs, enhancing the overall invoice management process.

Automating these invoicing processes not only saves time and effort but also reduces errors associated with manual data entry.

The system helps maintain accurate records, thereby improving efficiency and ensuring invoices are handled promptly and accurately.

This streamlined approach enhances interactions with customers and provides a more efficient financial transaction process, allowing businesses to focus on other critical aspects of operations.

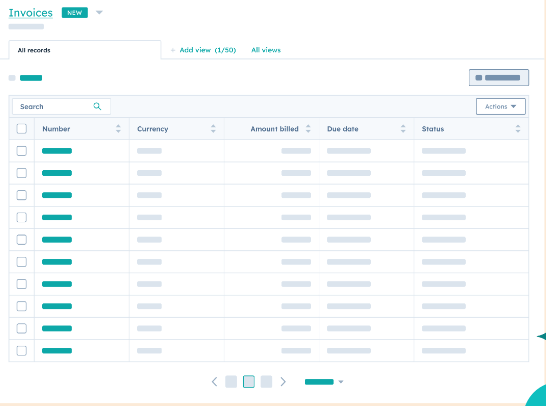

4. Managing and Tracking Invoices

Keeping track of invoices is important for businesses to make sure they get paid on time and keep their money flow steady. Using good accounting software helps a lot in keeping an eye on invoices and managing money well.

When picking accounting software, it’s crucial to choose one that fits the business needs.

It should have things like making invoices look the way you want, reminding people to pay, and easily working with other money systems.

Once the right software is set up, it helps in handling invoices smoothly and makes it easy to see how money is moving. It also helps in guessing how money will come in the future.

This way, businesses can make smart choices about money and find areas to make things better.

5. Integrating Payment Gateways and Reminders

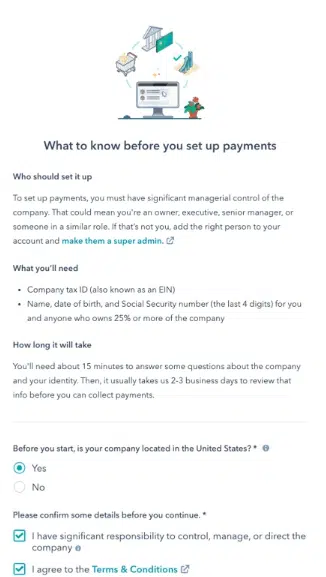

To integrate payment gateways and reminders into the accounting and payment software, follow these steps:

1. Finding Payment Options:

- Go to your HubSpot account and look for “Settings.”

- Click on “Payments” to see the different ways you can receive money.

2. Choosing a Payment Option:

- Pick a payment gateway from the list, like PayPal or Stripe.

- Follow the instructions to connect your chosen payment method to your HubSpot account.

3. Setting It Up:

- Enter the needed details and adjust the settings to match your business.

- Check to make sure everything is connected properly.

Creating Payment Reminders:

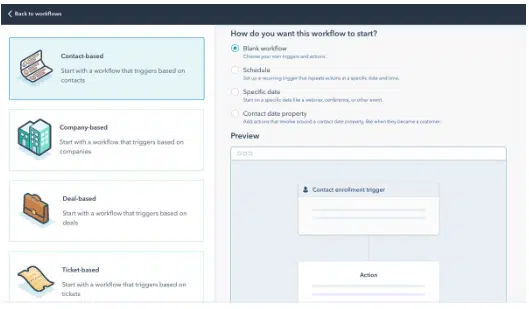

1. Starting a New Reminder:

- In HubSpot, find “Workflows” and click “Create Workflow.”

2. Picking the Reason for Reminders:

- Choose what should trigger the reminders, like if an invoice is overdue or a payment is coming up soon.

3. Deciding Who Gets Reminders:

- Set conditions to decide which customers or deals need payment reminders.

4. Writing Reminder Messages:

- Add actions to the reminder, like sending emails or messages to remind people to pay.

- Make the reminders friendly and helpful, including details about the amount due and a link to pay through your chosen payment gateway.

5. Testing and Starting:

- Try out the reminders to ensure they work right.

- Once you’re sure everything’s working well, activate the reminders. Now they’ll automatically remind people when payments are due or overdue.

Available on All Plans:

- HubSpot Sales Hub Plan

- HubSpot Marketing Hub Plan

- HubSpot Service Hub Plan

- HubSpot CMS Plan

- HubSpot Pricing Plan In Details

6. Leveraging Automation for Follow-Ups and Communication

Automation can be leveraged for follow-ups and communication in various ways. One way is by setting up automated reminders for pending charges, which helps ensure that all outstanding payments are followed up on promptly.

Another way is utilizing cloud-based software to streamline processes such as invoice tracking and payment scheduling, which enables seamless communication between the accounts payable team and vendors.

Automation has revolutionized accounts payable by making payments faster and easier.

With the use of automated accounting software, invoices can be processed and approved more efficiently, leading to quicker payment disbursal.

This not only improves vendor relations but also prevents late fees and allows for better cash flow management within the organization.

Furthermore, using automated accounting software ensures that payments are issued on time without manual input.

This reduces the risk of human error and also frees up valuable time for the accounts payable team to focus on more strategic tasks.

Overall, leveraging automation for follow-ups and communication in accounts payable can lead to increased efficiency, improved accuracy, and better vendor relationships.

7. Training Your Team for Effective Invoicing

Training your accounting team in effective invoicing is crucial for ensuring prompt and accurate payments from customers.

Start by educating them about the invoicing process and using proper documentation, emphasizing adherence to company policies and procedures.

It’s essential to emphasize the importance of accurately filling in invoice templates, including details like the correct billing address, purchase order number, itemized charges, and payment terms.

This ensures minimal accounting errors and facilitates timely payments from customers.

Introducing an invoicing program or service that includes mobile payment options can streamline business payments and help receive payments on time.

Moreover, utilizing financial reports with bank account details aids in making informed decisions about payment service providers and optimizing the invoicing process for smoother transactions.

Frequently Asked Questions About Invoice Tracking System

Here are some FAQs about Expense Tracking Software you should know-

1. Is the Invoicing Software Cloud-Based?

Yes, the modern invoicing software operates in the cloud and you can access and manage invoices from anywhere with an internet connection.

2. Does the Payment Tracking Software Allow for Multiple Users?

Yes! You can allow multiple users to work with your invoice or payment tracking software.

3. Is the Accounting Software Cost-Effective?

The Accounting software is cost-effective because it streamlines the financial processes reduces errors and keeps your organizational accounting information transparent.

4. What’s the most effective way to keep records of invoices?

Digital systems or software provide the most effective way to manage invoice records. Because, it offers searchable databases and centralized storage, ensuring quick access and organization of past invoices.

Final Thoughts

Keeping your invoicing books updated is super important for businesses to keep track of money coming in and ensure clients pay on time.

HubSpot’s Invoice software is a great tool for this! It makes creating invoices easy, sends automatic reminders for payments, and shows you in real-time who’s paid. This saves loads of time and keeps your invoicing books accurate and tidy.

Using HubSpot’s Invoice software makes tracking and making invoices quicker. This frees up time for business owners to focus on other important stuff while making sure payments are handled smoothly.

Plus, it gives you a good view of your business’s money situation, helping you make better decisions.

Remember, for top-notch invoice tracking: keep detailed records of all invoices, follow up on payments regularly, set clear payment terms, and use trustworthy software like HubSpot.

I hope you found these tips helpful! Share this article with your friends and let me know what you think in the comments below. If you want to learn more about managing invoices smartly, stay tuned for more useful tips!